After working for me for ten years, Joe (not his real name) decided to quit and start a competing plumbing business. On his last day, I drove him home. We had his exit interview in my truck. I asked, “Do you think there is any more I could have done for you as an employer or friend?” Joe said, “No. You’ve done more for me than anyone has done for me in my entire life.” His response blew me away.

When Joe first came to work for me, he was making less than $40,000 a year. He was in debt. He didn’t own a home. But over the course of his employment, Joe was able to buy his first home and got completely out of debt. He became very involved in the community and is an incredibly generous and successful human being.

It was then I understood the power of teaching financial literacy. It changes people’s lives and generations that follow. Over the years, I’ve witnessed this chain reaction of financial empowerment repeatedly with my employees. I’ve always been grateful to see their evolution.

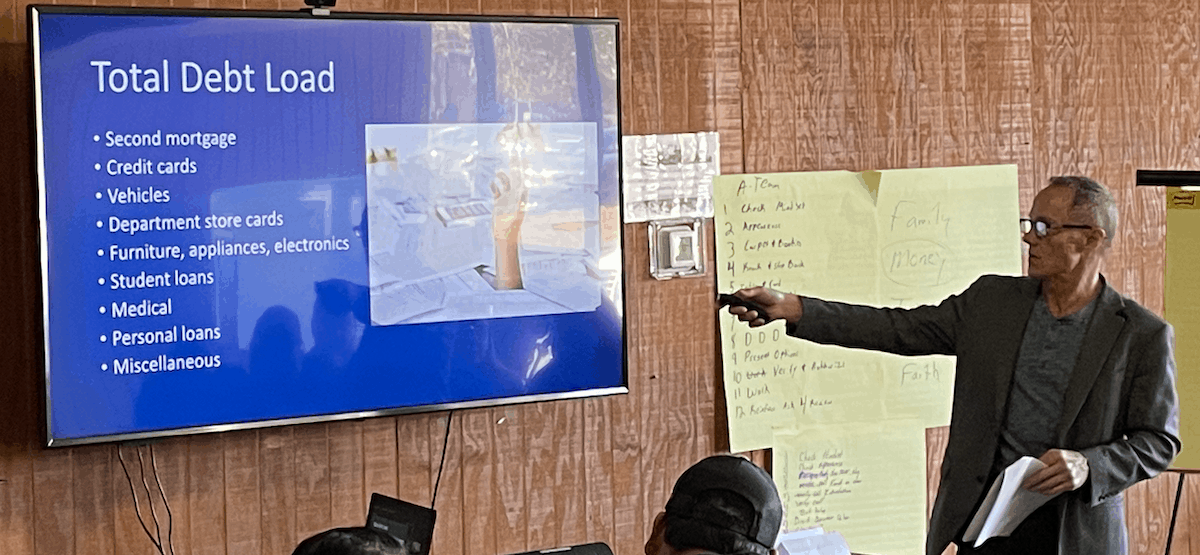

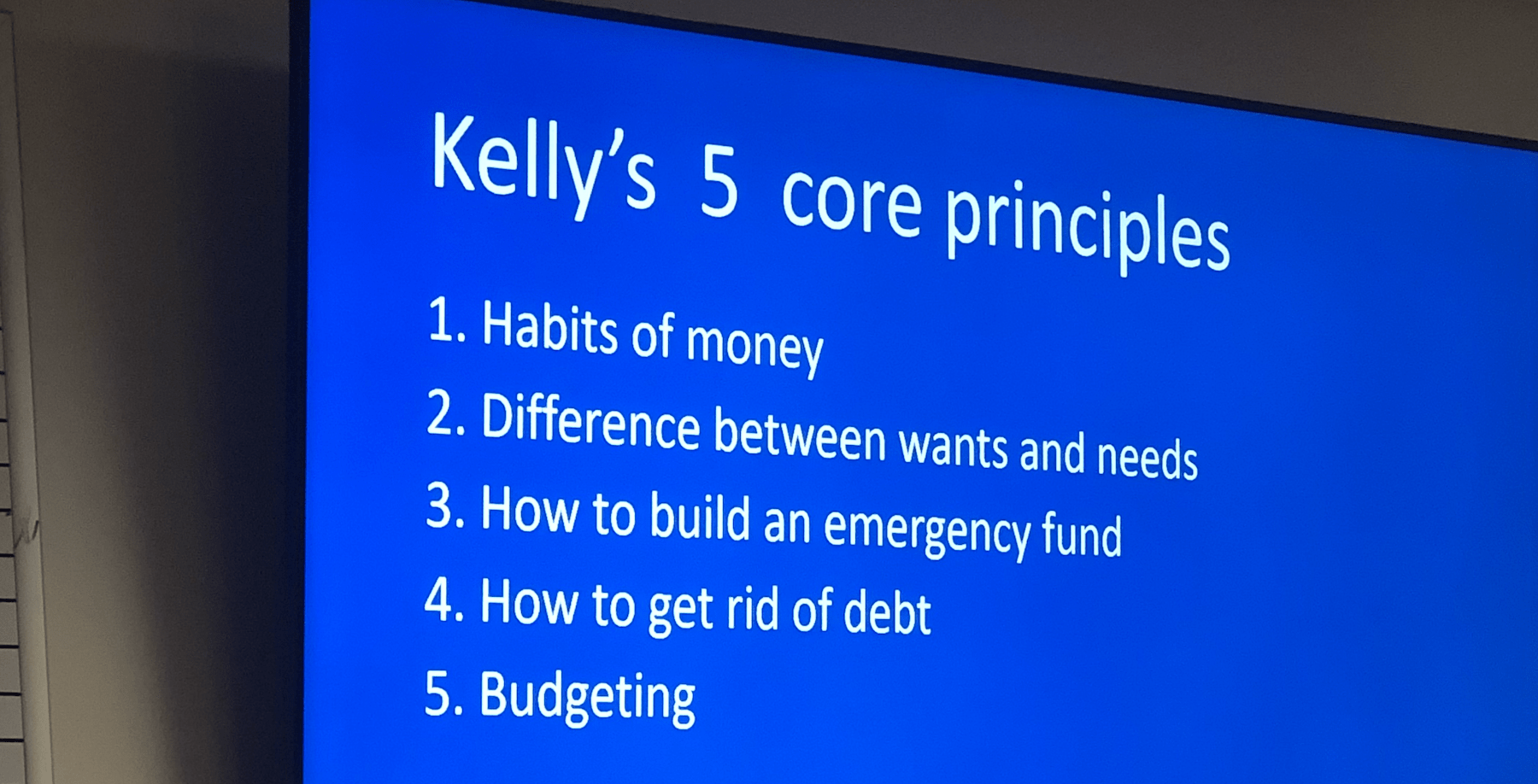

These days employers need to find creative ways to attract and retain employees. They need to find ways to generate loyalty too. Teaching financial literacy is a strategic benefit that employers can use to attract, retain, and build loyalty among their employees both at work and at home. But for someone to be successful with their finances, the whole family needs to be on board. For this reason, I strongly suggest that when a client chooses to sponsor a Financial Freedom workshop for their employees, family and extended family also attend.

These days employers need to find creative ways to attract and retain employees. They need to find ways to generate loyalty too. Teaching financial literacy is a strategic benefit that employers can use to attract, retain, and build loyalty among their employees both at work and at home. But for someone to be successful with their finances, the whole family needs to be on board. For this reason, I strongly suggest that when a client chooses to sponsor a Financial Freedom workshop for their employees, family and extended family also attend.

From experience, I know that when family members attend the class, the positive impact on that family’s life will compound. I’ve had grandparents, aunts, uncles, and even children attend my Financial Freedom workshops. Everyone loves it when kids come. They’re super engaging and ask a lot of interesting questions. It often surprises the adults to see how much kids love learning about finances. The biggest compliment comes when those kids come up to me after the class to say, ‘Thank you! They don’t teach this at school.” Well, lucky for them, their parent’s employer thinks it’s important enough to teach it at work.

After all, it starts with one. One person who sees the future in a new way. One person who dreams of living debt-free. One person who makes the small daily choices that will set them up for a lifetime of financial freedom. The freedom they will share with future generations.