I make people look at their finances; I make them acknowledge their debt. So many people will bury their heads in the sand and think their debt will magically disappear. It won’t. Just like anything else, when you can really look at it, and acknowledge it, that’s when you can start to work on it.

I make people look at their finances; I make them acknowledge their debt. So many people will bury their heads in the sand and think their debt will magically disappear. It won’t. Just like anything else, when you can really look at it, and acknowledge it, that’s when you can start to work on it.

There are so many tools out there for people to learn how to become debt-free. But those tools are worthless until people acknowledge the problem. Once recognized, we can formulate a plan. A plan that works. That’s the part I love. Because the plan becomes the key to financial freedom. Not just for one person but for future generations. Working with people in this way is what drives me and keeps me going.

I’m working with a gentleman right now that had $228,000 worth of debt. He’ll be debt-free in less than 26 months. And it’s pretty amazing when you can do that with someone and show them how to live by debt-free living principles. It’s life-changing.

78% of Americans live paycheck to paycheck according to a Forbes study. That’s 7 out of 10 people; a pretty scary statistic. It surprises many employers when they find out that employees miss just as much work because they struggle with finances as they do because of health and sickness issues. So if you can help employees in straightening out their finances, it will not only help them become better people but better employees too.

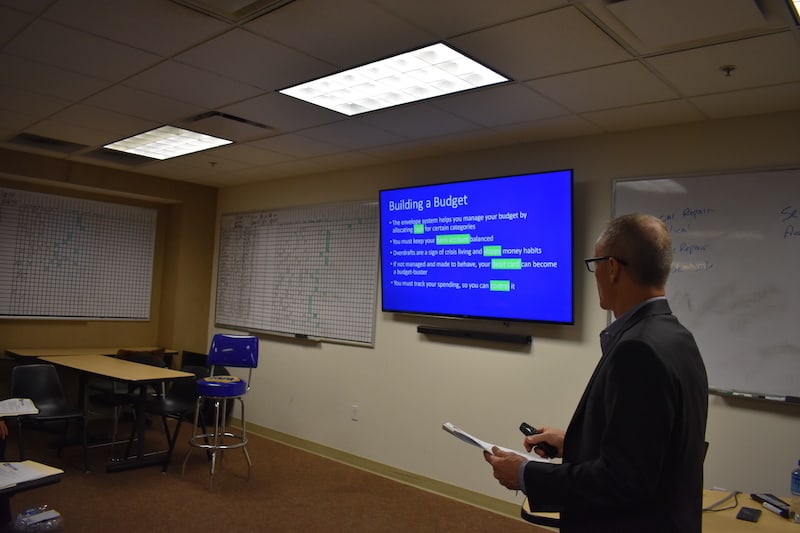

A lot of people have never been taught how to balance a checkbook. In my classes, everyone gets to learn what a checkbook is. Believe it or not, some young people have never seen one. They grew up with a virtual view of money. But I believe there is absolute power in holding real money in your hand and learning to balance an actual checkbook. It helps people understand how to track their money and tell them what to do instead of their money telling them. It’s fun to be able to teach people those very basic principles.

I used to be one of those employers who struggled with employees coming in asking for draws or loans. An employee’s financial health also ties back to a company’s struggles with retention and recruitment. I recently read a Linkedin Report statistic that stated 94% of employees would stay longer at a company if it invested in helping them learn.

In 2014 I became passionate about teaching others to become financially free. Back then, I owned a company where we invested a lot into our employees. We offered all kinds of training four to five days a week. We’d teach everything from personal development, customer service, and sales skills, and all sorts of technical skills. One day we were looking for content for personal growth. My general manager, Brad, said, “Why don’t we do some Dave Ramsey training?” I asked, “who’s Dave Ramsey?” I did some research and realized I’d lived my life by Dave Ramsey’s principles.

I became a Dave Ramsey facilitator to teach “Core Financial Wellness” at the time. My mission was to help my employees, and their spouses become financially free and learn to live within their means. I took a group of 14 employees, and together we took their total debt load from 186,000 to 146,000 in about four months. That got me excited and ignited my passion to go further.

There are so many things we can be teaching our employees. Financial freedom is often overlooked, but I’ve witnessed the power of this training to benefit a company at the core of its operations because it empowers people in a way that affects them personally. It’s truly the gift that keeps on giving for generations to come.