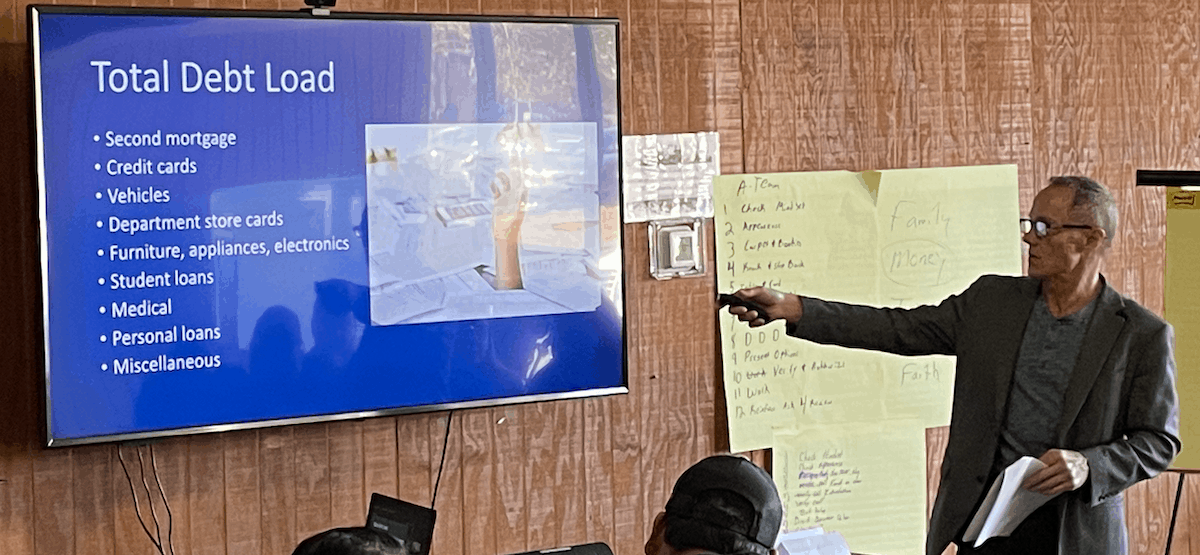

When I teach my Financial Freedom classes, I talk a lot about acknowledging the past and accepting it. What do I mean when I say that? I’m talking about taking a close hard look at your total debt. A lot of people just want to bury their heads in the sand. They don’t want to acknowledge their debt. When we refuse to take a look, things never get better. They usually get a whole lot worse. Conversely, when we take a look and see where we stand, we can make choices about our future. We can live like few people do.

When I teach my Financial Freedom classes, I talk a lot about acknowledging the past and accepting it. What do I mean when I say that? I’m talking about taking a close hard look at your total debt. A lot of people just want to bury their heads in the sand. They don’t want to acknowledge their debt. When we refuse to take a look, things never get better. They usually get a whole lot worse. Conversely, when we take a look and see where we stand, we can make choices about our future. We can live like few people do.

I had a client a few years ago who went through some hardships, and some struggles. And when I finally got him to sit down and acknowledge where he stood financially, he had amassed well over $100,000, worth of debt. We came up with a plan. And within 26 months from now, he will be completely debt-free.

He would never have accomplished financial freedom if he refused to acknowledge where he was. Acknowledgement was his first step before he could put a plan in place. So work on it and acknowledge it. Yeah, it puts a pit in your stomach—but acknowledge where you stand. The road to any recovery is accepting the past and moving forward. And that’s what we want to do when it comes to becoming financially free.

Next, we need to look at our relationship with money in relation to our spouse, significant other, or any other person who needs to feed from the family pie. It’s essential that everyone knows where the family stands when it comes to money.

When my wife and I were building our net worth and working on what we wanted to do when it came to finances, we would sit down and discuss money, very often. We would sit at the dinner table four to five nights a week and talk about it. But the conversation was not just between the two of us. We’d bring our kids to the table. We’d sit down and do the budget together. We’d figure out what we wanted as far as our goals and dreams and talk about it. Get agreement and buy-in.

My wife and I were also clear on what role we each played when it came to money. I was the ‘nerd’ who balanced our bank statements and budget to the penny every month. My wife was a free spirit. She didn’t really care about money as long as there was money in the bank.. But I would sit down with her every month and show her what we had. And if you do that, you make sure you’re on the same page, and this habit saves a lot of marriages and relationships. Make sure you communicate when it comes to money.

When our kids went out on their own, they had a foundation of knowledge and understanding to build on. I’m happy to say they are both financially stable adults and I couldn’t be happier about that.

They’re out in the world, and they’re completely debt-free. Financially freedom is a legacy that my wife and I were able to pass off to our kids.

Society tells us we got to have debt. Society says you’ve got to have a car payment, you’ve got to have a house payment, you got to have all these different payments. You know what? I don’t want payments, and not only that, I don’t have payments. You’re not going to get rich getting into more debt. It pays to think hard and long about taking on more debt.

I have a client in Southern California that I’ve known for years. Pre-2008, he was bringing home $30,000 a month. He was making a lot of money. He kept buying things and kept borrowing more money, and more money, and more money.

I kept telling him, ‘Don’t be a debt dummy! If I was you I’d be paying off my debt, not getting into more.” Well, guess what? 2008 happened. His business went under. And four years later, he called me and asked to borrow $5,000 so he could buy a used pickup to start another company. Was I shocked? No. Not at all.

When it comes to being financially free and debt-free, you’ve got to really think about what you want and what you need. For example, when you go into the grocery store, hopefully, you take a list with you. Because if not, you’re just filling the shopping cart up with whatever’s there. You’re likely getting some of what you need but also something extra. And if you forget what you need, then you’re back at the store, spending more gas and time to boot.

Anything that you’re purchasing, anything you’re doing, you got to think, do I need it? Do I want it? When our kids were young, that’s something that my wife and I would ask our kids. Do you want it? Or do you need it?

Not long ago, I was speaking at a conference on the subject of financial literacy. Somebody asked me a question about wants and needs. The conference was being live-streamed on Facebook. My youngest daughter was watching. As I started talking on the subject of wants and needs, she picked up her phone and she started texting me. I didn’t have my phone with me. So I didn’t see what she was texting. When I looked later I could see a long list of texts: “No! Dad! Please. Don’t say it!”

Here’s what I told my audience: When my girls were growing up, they’d come to me with their hands out when they wanted something. “Dad, I want this. Dad, I want that.” I’d say, “Hold both your hands out. Want in one, crap in the other, and see which one fills up first.” I don’t want to hear that you want something. I’ve said before and I’m going to say again, if you pay attention to your needs now, you can have what you want later. And that’s what we were able to do in my family. We lived like nobody else, and later we were able to live like nobody else. You can too.